Why Residents Choose Our Santa Clara Tax Services

When it comes to handling taxes in Santa Clara, Utah, our team of professionals provides unmatched reliability, accuracy, and personal attention. We pride ourselves on being the most trusted name for individual tax preparation, small business accounting, and IRS resolution services. From start to finish, we ensure every client receives customized support with up-to-date knowledge of federal and state regulations.

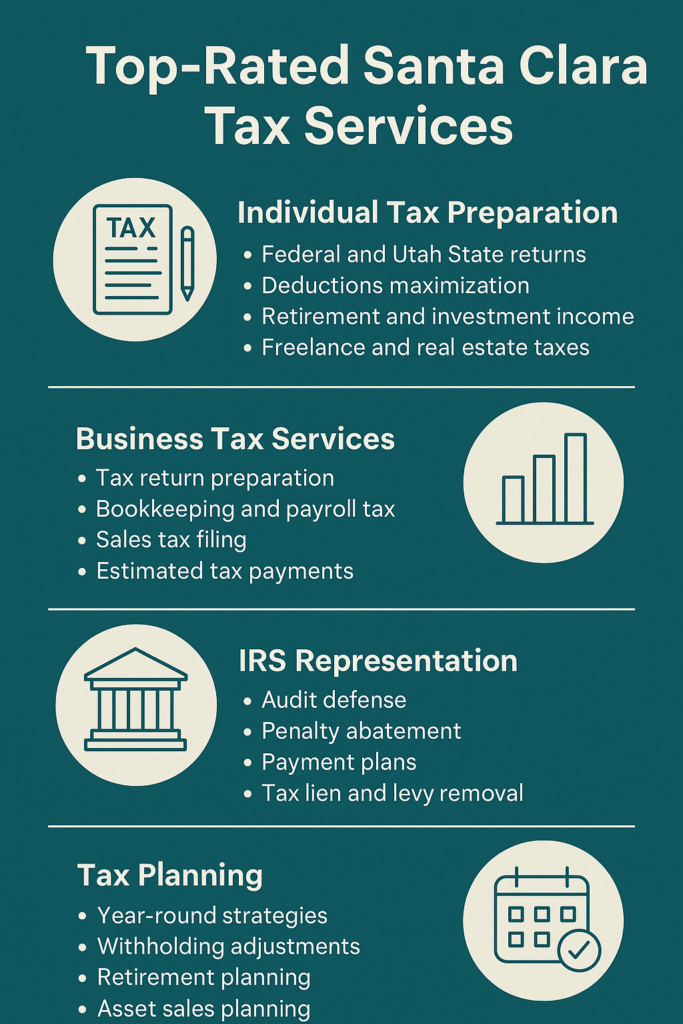

Comprehensive Individual Tax Preparation in Santa Clara

We understand that tax season can be overwhelming. That’s why we offer comprehensive tax preparation services for individuals and families across Santa Clara. Whether you’re filing a straightforward W-2 or have a complex return involving multiple income streams, deductions, or investment properties, our licensed tax professionals take care of everything.

Key services include:

- Preparation of Federal and Utah State returns

- Deductions maximization (mortgage, student loans, childcare, medical expenses)

- Retirement income and Social Security tax planning

- Schedule C for freelancers and independent contractors

- Real estate and rental property tax strategies

- Investment income reporting and crypto tax compliance

Our digital-first approach means you can submit documents securely from your phone or computer, and we’ll handle the rest.

Business Tax Services for Santa Clara Entrepreneurs

Owning a business in Santa Clara requires more than just hustle—it requires smart tax planning. We help small business owners, LLCs, partnerships, and corporations navigate their annual and quarterly tax obligations with precision.

We provide:

- Business tax return preparation (Forms 1120, 1120S, 1065)

- Bookkeeping and QuickBooks integration

- Payroll tax compliance

- Sales and use tax filing

- Profit and loss analysis for year-end planning

- Estimated tax payments and quarterly projections

- Entity formation consultations (LLC vs S-Corp benefits)

From Main Street storefronts to remote freelancers, our customized solutions are designed to save you money while keeping you compliant.

IRS Representation and Tax Problem Resolution

If you’ve received a letter from the IRS, don’t panic. Our tax resolution specialists are experts in handling audits, back taxes, wage garnishments, and liens. We act on your behalf to resolve tax issues quickly and professionally.

Our tax resolution services include:

- Audit defense and representation

- Filing unfiled returns

- Penalty abatement

- IRS payment plans and installment agreements

- Offer in Compromise (OIC) assistance

- Tax lien and levy removal

We’ve helped dozens of Santa Clara residents and business owners regain peace of mind and financial control.

Tax Planning: Strategic Guidance All Year Round

Effective tax planning doesn’t start in April. Our team offers year-round tax strategies tailored to help you retain more of your income. Through proactive planning, we reduce your taxable income and avoid unnecessary liabilities.

Tax planning services include:

- Tax projections and withholding adjustments

- Retirement planning (IRA, Roth IRA, SEP contributions)

- Capital gains timing and asset sales planning

- College savings and 529 plan strategies

- High-income earner strategies and AMT mitigation

We work hand-in-hand with our clients to implement forward-looking strategies that align with personal and business goals.

Santa Clara Tax Services for Real Estate Investors

Santa Clara is rapidly becoming a hub for real estate activity, and our tax firm is deeply experienced in real estate investor tax needs. Whether you’re flipping houses, managing rentals, or doing 1031 exchanges, we provide accurate, strategic tax solutions.

Real estate tax specialties include:

- Depreciation schedules

- Passive activity loss rules

- Cost segregation studies

- 1031 exchange guidance

- Short-term vs long-term capital gains planning

- Real estate professional status optimization

We ensure your properties are not just profitable but tax-efficient.

Retirement and Senior Tax Services in Santa Clara

Navigating taxes in retirement is different. We help retirees and seniors manage income from Social Security, pensions, IRAs, and annuities, ensuring you never overpay in taxes while complying with required minimum distributions (RMDs).

Senior-focused services:

- Social Security taxability analysis

- Roth IRA conversion strategy

- Healthcare premium deduction tracking

- Required Minimum Distribution (RMD) planning

- Tax-efficient withdrawal strategies

- Estate and trust tax returns (Form 1041)

Let us help you enjoy your retirement with confidence and clarity.

Why Locals Trust Our Santa Clara Tax Professionals

What sets us apart is our commitment to personalized service, accurate returns, and ethical tax practices. Clients return year after year because of our:

- Transparent pricing and no hidden fees

- In-person and virtual consultations

- Fast electronic filing and direct deposit

- Year-round availability—not just during tax season

- Local knowledge of Utah tax laws

- Friendly, bilingual staff

We’ve built our reputation one return at a time—through trust, results, and relationships.

Serving All of Washington County from Our Santa Clara Office

While our office is centrally located in Santa Clara, we proudly serve clients across Washington County, including St. George, Ivins, Washington City, Hurricane, La Verkin, and Leeds. Whether you’re a retiree in Ivins or a startup in St. George, you’ll receive the same attentive, high-quality tax care.

Schedule Your Tax Consultation Today

We’re ready to take the stress out of your tax season and help you plan for a better financial future. Whether you’re looking for individual tax filing, business tax strategies, or IRS resolution—our Santa Clara tax professionals are here to serve.

Call us today or schedule your free consultation online. Let’s build your best tax year ever.