Why Southern Utah Chooses BHT Tax Services

We are BHT Tax Services, a locally rooted, technology‑driven firm that empowers individuals, families, and businesses throughout Washington County and Iron County to keep more of what they earn. Leveraging best‑in‑class software, up‑to‑the‑minute regulatory insight, and a team of seasoned Enrolled Agents and CPAs, we file flawlessly, plan proactively, and defend decisively—all while delivering the friendly, small‑town service our neighbors expect.

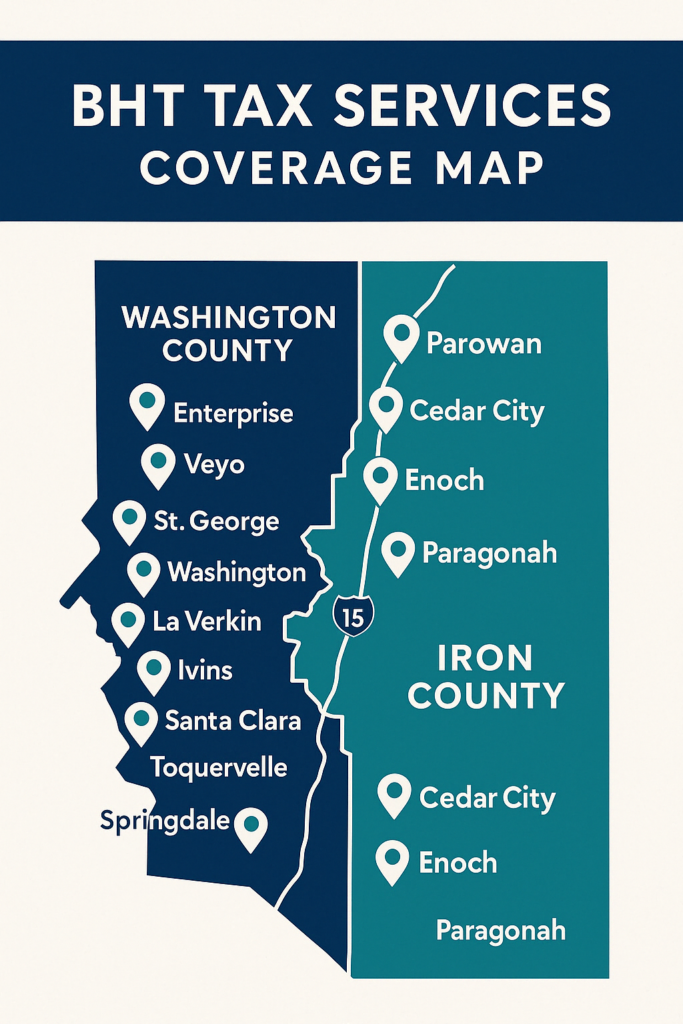

Complete List of Towns We Proudly Serve

Washington County

- St. George – The economic heartbeat of Southwest Utah

- Washington City

- Hurricane

- Santa Clara

- Ivins

- La Verkin

- Toquerville

- Springdale (gateway to Zion National Park)

- Virgin

- Rockville

- Leeds

- Enterprise

- Veyo

- Central

- Dammeron Valley

- New Harmony

- Apple Valley

- Hildale

- Colorado City (AZ clients welcomed)

- Smaller communities such as Gunlock, Pine Valley, Brookside, and every rural route in between

Iron County

- Cedar City – Home of SUU and the Utah Shakespeare Festival

- Enoch

- Parowan

- Brian Head (vacation‑home specialists)

- Paragonah

- Kanarraville

- Newcastle

- Beryl Junction / Beryl

- Summit

- Hamilton’s Fort

- Modena

- Lund

- Unincorporated areas from Three Peaks to the Little Salt Lake Valley

We travel or meet virtually anywhere clients live, work, or invest throughout these counties—no address is too remote.

Personal Tax Preparation Built Around Your Life

Maximizing Every Deduction & Credit

We dig deeper than generic, one‑size‑fits‑all software. Expect meticulous line‑by‑line reviews to capture education credits, solar and energy‑efficiency incentives, health‑saving deductions, and the often‑overlooked Utah retirement‑income exemption.

Multi‑State & Expat Expertise

Snowbirds commuting between Utah and Nevada or digital nomads working from Bangkok (yes, we do that!) receive precise apportionment so they never overpay.

Audit Defense—Included

Should the IRS or Utah State Tax Commission come knocking, our enrolled agents respond, represent, and resolve at no extra cost for returns we prepare.

Strategic Tax Planning for Small Businesses

Entity Optimization

From LLCs in St. George to S‑corps in Cedar City, we calculate the golden mean between self‑employment taxes and payroll compliance to unlock legally larger profit margins.

Quarterly Estimated‑Tax Management

No more surprises on April 15. We forecast revenue, set automated reminders, and fine‑tune throughout the year so cash flow—and peace of mind—remain steady.

Bookkeeping & Payroll—One Dashboard

Our cloud platform integrates QuickBooks Online, Gusto Payroll, and secure document portals, keeping P&Ls, 941s, and W‑2s perfectly aligned.

Real‑Estate & Investor‑Focused Solutions

Southern Utah’s boom in short‑term rentals, multifamily syndications, and land development demands nuanced guidance:

- Cost‑Segregation Studies to accelerate depreciation on cabins in Brian Head or condos near Zion

- Section 1031 Exchanges for investors upgrading properties across county lines

- Opportunity‑Zone Planning in eligible census tracts around Parowan and Enterprise

Virtual Filing—Fast, Secure, Anywhere

- Snap & Send documents through our encrypted mobile app.

- Video Review with your preparer—screen‑share every line.

- E‑Sign & E‑File—returns accepted in as little as 24 hours.

Whether you’re stationed at Hill AFB, studying abroad, or trucking I‑15, we bring the tax office to you.

Specialized Services

| Service | Perfect For | Key Benefit |

|---|---|---|

| Back‑Tax Resolution | Filers with unfiled years | Freeze penalties, negotiate manageable payment plans |

| Non‑Profit Compliance (Form 990) | Churches & charities in Hurricane or Parowan | Maintain tax‑exempt status effortlessly |

| Trust & Estate Returns | Families with generational ranches | Preserve wealth across heirs |

| ITIN Application Assistance | Foreign investors in Iron County real estate | Legally receive US rental income |

What Sets Us Apart

- Local Roots, National Reach – We sponsor little‑league teams in Enoch yet handle transactions in 40 states.

- Fixed, Upfront Pricing – No ticking clock; you’ll know the fee before we start.

- Year‑Round Availability – Extension season, harvest season, or powder season, our phones stay on.

- Community Commitment – Annual “Be Hope Today” free filing days for seniors and first‑year entrepreneurs.

Client Success Stories

“BHT restructured my landscaping company from a sole prop to an S‑corp, saving $8,732 in self‑employment tax the first year.”

—Jason T., Washington City

“After moving to Santa Clara, I had rental income in three states. BHT’s team filed everything flawlessly, and the video conference made it easy—even with my crazy nursing schedule.”

—Olivia M., Travel RN

“Our cabin in Pine Valley qualified for huge bonus depreciation we never knew existed. Five‑star service.”

—Derrick & Shay L.

How to Get Started Today

- Call (435) 704-1307 or schedule online for a free 15‑minute discovery call.

- Receive a personalized document checklist.

- Relax while we transform your paperwork into maximum legal savings.

Early‑bird discount: New clients who onboard before January 31 receive $50 off their first return.

Frequently Asked Questions

Do you offer drop‑off service?

Yes. Secure lockboxes are available in St. George, Hurricane, and Cedar City—open 24/7.

Can you help if I live outside the listed towns?

Absolutely. We file for clients across Utah and every U.S. state. Distance is never a barrier.

Are virtual meetings secure?

We use 256‑bit encrypted portals and two‑factor authentication on every file and e‑signature.

What credentials do your preparers hold?

Our senior staff are CPAs and Enrolled Agents (EAs), authorized to represent you before all tax authorities.

Take the Next Step Toward Stress‑Free Taxes

Ready to experience the Southern Utah tax team that treats you like family and thinks like strategists?

Click “Book Now,” call (435) 704-1307, or visit us at www.BHTTaxServices.com. Let’s turn complex tax codes into concrete savings—together.